Storm Damage Inspection

What are we inspecting?

Our inspectors are construction and investigation professionals (not salesmen) who are looking at the overall condition of the roof, specifically for storm-related damages. This often involves inspecting other exterior surfaces around the property as well.

What is the benefit of all of this?

A roof nearing it’s end of functional life is going be a sizeable cost. If the property has been damaged by a storm, the repairs are likely covered under a typical insurance policy.

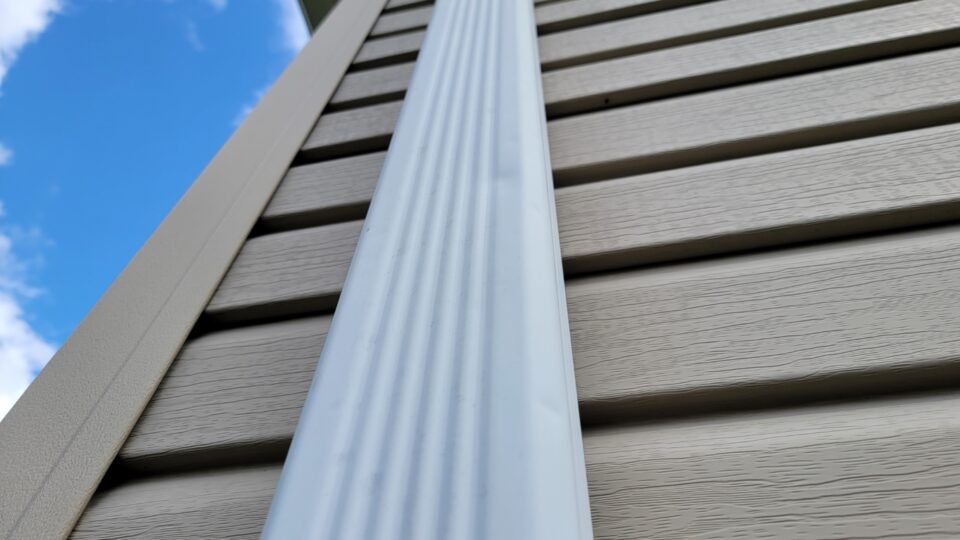

Our team can give an overall health report of the roof and other systems. The property could qualify for tens of thousands of dollars worth of repairs to the roof, siding, gutters – whatever items have been damaged, and all funded by insurance.

What costs are there?

The inspection is free and pursuing the claim is free. There is no cost unless the claim is approved and it’s time to begin the repair work. That cost is the insurance deductible each property owner has chosen with their insurance. Most deductibles are $1000. By law, a contractor cannot absorb deductibles.

We do all of this under the agreement that we get to complete the insurance-approved work for the insurance-approved price.

What happens after the inspection?

We will provide a report of our findings and a professional account of the best options.

Should the owner choose to move forward with a claim, we will provide a written report including photos and instructions of how to file the claim. If the claim is approved, we will complete the insurance-approved work for the insurance price and our claim team will deal with any the underpayments ourselves.

How the claim is filed is more than half of the battle with insurance. Providing the right information, omitting the wrong information, and effectively building a case for insurance coverage allows us to win 9/10 of the claims we undertake. Conversely, the common claim success rate of a traditional roofer is around 3/10.

Who is Steel Image and why use them?

We are the premium storm repair contractor in the Indianapolis area. Our inspection team includes licensed contractors, engineers, and public insurance adjusters to get claims approved at a rate which is untouchable by even the most established competition.

The three most important factors when choosing a contractor are:

- Can they get my claim approved?

- Is this contractor’s work of high quality?

- Are they going to try to sell me a bunch of upgrades?

Steel Image has the highest claim approval success rate in Indiana – 89% as of 2021. The roof, siding, and gutter systems we install for the insurance funds are warrantied by the manufacturers to be free from defects for up to 50 years and include nearly all of the accessory protections that other contractors charge thousands to add-on.

Are there any other disclaimers if we do file a claim?

This entire offer is dependent on the property being fully insured – commonly called Replacement Cost Insurance. If the property isn’t fully insured, the resulting claim may be approved but will not fully fund the work. This will make the cost out of pocket to complete the work greater than just the deductible.

In this situation, the owner can cancel our agreement for only 25% of the claim amount – effectively similar to how public claim adjuster services charge to get claims approved. Remaining funds can be used however they choose. This is still a win for the owners, but a lesser win.